what is fsa health care 2020

When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether. A Health Care Flexible Spending Account FSA allows you to set aside tax-free dollars each year for health care expenses not covered by insurance.

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

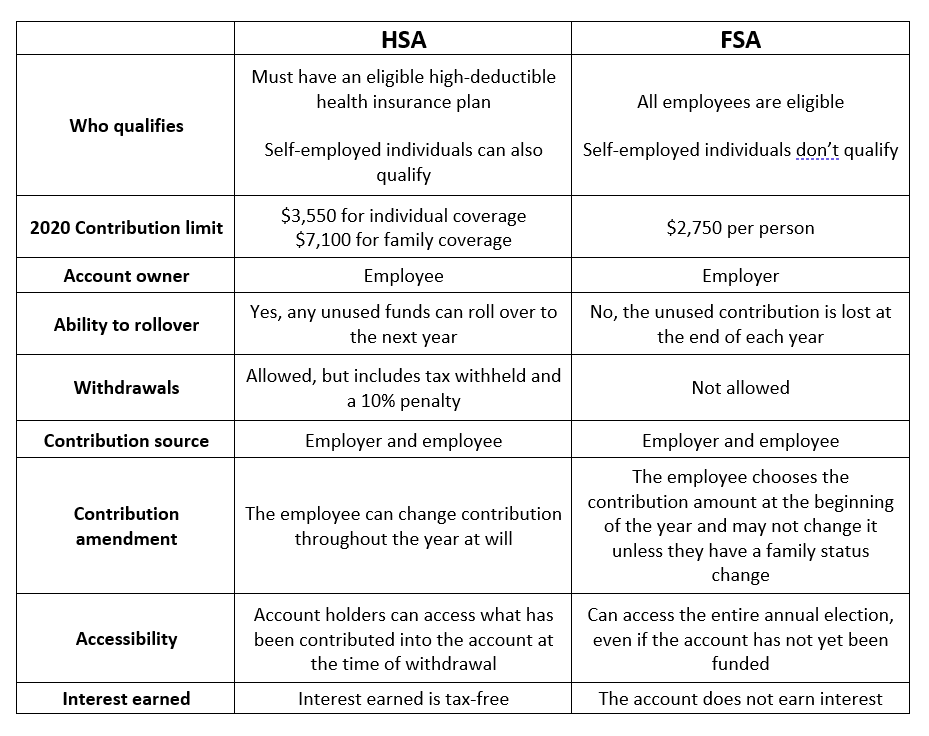

Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences.

. A medical flexible spending account FSA is a tax-advantaged account maintained by employers where employees can set aside a portion of each paycheck to pay for out-of-pocket medical. An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. Ad Looking to Transition to Value-Based Care.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. The increase also applies. Download Our Complimentary Guide on VBC ACOs.

An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical. Your employer provides and. Elevate your health benefits.

Weve Helped 10000 Patients Achieve Greater Health Outcomes While Reducing Cost of Care. Download Our Complimentary Guide on VBC ACOs. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses.

If your employer offers this as a benefit you can put money into an account to pay for various medical expenses that arent. For one self-employed individuals arent eligible. Weve Helped 10000 Patients Achieve Greater Health Outcomes While Reducing Cost of Care.

Here is a breakdown of how an FSA and HSA differ. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Ad Looking to Transition to Value-Based Care.

Your employer may also choose to. Tax-free interest or other earnings on the money in the account. But Section 4402 of the 2020 Coronavirus Aid Relief and Economic Security CARES Act changed that allowing pre-tax FSA funds to be used for over-the-counter drugs.

You contribute to an FSA with pre-tax dollars deducted from your payroll and you can withdraw FSA funds for. You may use these funds to pay for eligible. An Flexible Spending Account FSA is a valuable employee benefit that allows you to have pre-tax dollars withheld from your paycheck to pay for eligible health care or dependent care.

Your Health Care FSA covers hundreds of eligible health care services and products. Easy implementation and comprehensive employee education available 247. A Flexible Spending Account FSA is a type of savings account available in the United States that provides the account holder with specific.

A flexible spending account FSA is a tax-advantaged health care account. You can use your Health Care FSA HC FSA funds to pay for a wide variety. Get a free demo.

Ad Custom benefits solutions for your business needs. For 2021 you can contribute up to 3600 for self-only up to. A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses.

HSAs are referred to as providing triple tax savings. Other key things to know about FSAs are. An FSA is a type of account called a flexible spending account.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or. Theres one important restriction on FSA money.

For 2020 employees can contribute 2750 to health FSAs up from the 2019 limit of 2700 the IRS said in Revenue Procedure 2019-44. One of the biggest benefits. Flexible Spending Account - FSA.

For 2021 you can contribute up to 2750 to a healthcare FSA. Pre-tax dollars are put aside from your paycheck into your FSA. You have to use all the money that goes into it within the year.

An FSA is a type of savings account that provides tax advantages. Healthcare FSAs are a type of spending account offered by employers. In 2020 the limit is 2750 for a health care FSA.

Generally FSAs can be used to.

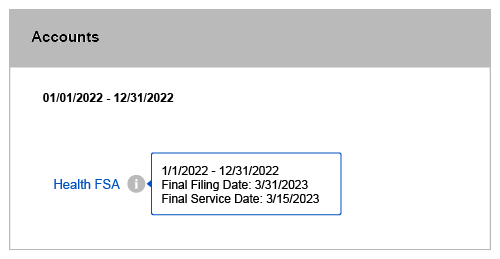

Fsa Carryover What It Is And What It Means For You Wex Inc

How To Use Your Fsa For Skincare California Skin Institute

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Flexible Spending Accounts Fsa 2020

Health Care Flexible Spending Accounts Human Resources University Of Michigan

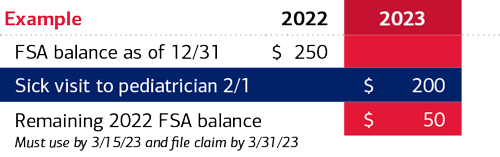

Understanding The Year End Spending Rules For Your Health Account

Understanding The Year End Spending Rules For Your Health Account

Hsa Vs Fsa What S The Difference Quick Reference Chart

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Understanding The Year End Spending Rules For Your Health Account

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

What Vision Expenses Does My Fsa Cover Readers Com

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Flexible Spending Accounts Fsa 2020

Medical Flexible Spending Account Healthinsurance Org

Hsa And Fsa Accounts What You Need To Know Readers Com

Hsa And Fsa Eligible Expenses For Mom Baby And Parents To Be